vermont income tax forms

Estimated tax payments must be sent to the Vermont Department of Taxes on a quarterly basis. Like the Federal Income Tax Vermonts income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

California Tax Forms H R Block

Vermont State Income Tax Return forms for Tax Year 2021 Jan.

. Mon 01242022 - 1200. Individual Income Estimated Tax Payment Voucher Estimated. Enter the smaller of Line 8 or 5 000.

The current tax year is 2021 with tax returns due in April 2022. Ad Get A Jumpstart On Your Taxes. Income is subject to four tax rates in the state.

These back taxes forms can not longer be e-Filed. Other Vermont Individual Income Tax Forms. To avoid paying interest and penalties have both your taxes paid and your return filed by April 18 2022.

We last updated Vermont Form IN-111 in February 2022 from the Vermont Department of Taxes. From Simple to Advanced Income Taxes. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding.

If you received Form 1099-G for unemployment compensation from the Vermont Department of Labor and have questions please review information on the Department of Labors website. Get and Sign in 111 Vermont Income Tax Return Vermont Department of Form Use a vermont schedule in 153 template to make your document workflow more streamlined. Vermonts income tax is nearly as complex as the federal calculation.

Vermonts maximum marginal income tax rate is the 1st highest in the United States ranking directly. Vermont Personal Income Tax Return Form IN-111 DEPT USE ONLY Vermont Department of Taxes 2021 Form IN-111 Vermont Income Tax Return 211111100 2 1 1 1 1 1 1 0 0 Please PRINT in BLUE or BLACK INK FILE YOUR RETURN ELECTRONICALLY FOR A FASTER REFUND. Vermont Legal Forms - Vermont Income Tax Forms.

This form is for income earned in tax year 2021 with tax returns due in April 2022We will update this page with a new version of the form for 2023 as. The 1099-G is a tax form for certain government payments. Vermont Income Tax Forms.

On Schedule IN-112 Part I Line 7. You can use the myVTax website to. Vermonts tax system consists of a state personal income tax estate tax state sales tax local property tax local sales taxes and a number of additional excise taxes on products like gasoline and cigarettes.

No Matter What Your Tax Situation Is TurboTax Has Your IRS Taxes Covered. The state income tax table can be found inside the Vermont Form IN-111 instructions booklet. While most taxpayers have income taxes automatically withheld every pay period by their employer taxpayers who earn money that is not subject to withholding such as self employed income investment returns etc are often required to make estimated tax payments on a quarterly basis.

00 Page 1 of 2 Schedule IN-153 Rev. IN-111 can be eFiled or a paper copy can be filed via mail. The Vermont income tax rate for tax year 2021 is progressive from a low of 335 to a high of 875.

Our state specific forms documents are all prepared by attorneys with your Satisfaction Guaranteed. Vermont State Income Tax Forms for Tax Year 2021 Jan. Over 50 Million Tax Returns Filed.

Most Popular Vermont Products and Services. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. 31 2021 can be e-Filed along with an IRS Income Tax Return by the April 18 2022 due dateIf you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penaltyHowever if you owe Taxes and dont pay on time you might face late tax payment.

GO TO TAXVERMONTGOV FOR MORE INFORMATION. Vermont has a state income tax that ranges between 335 and 875 which is administered by the Vermont Department of TaxesTaxFormFinder provides printable PDF copies of 52 current Vermont income tax forms. The Vermont Form IN-111 instructions and the most commonly filed individual income tax forms are listed below on this page.

Vermont has a state income tax that ranges between 3350 and 8750. Individuals filing state returns submit Vermont Form IN-111. 1021 DEPT USE ONLY Vermont Department of Taxes 2021 Form IN-111 Vermont Income Tax Return 211111100 2 1 1 1 1 1 1 0 0 Please PRINT in BLUE or BLACK INK FILE YOUR RETURN ELECTRONICALLY FOR A FASTER REFUND.

Ad IRS-Approved E-File Provider. As I count them Vermont has 11 income tax-related forms four income tax schedules five worksheets and two application. Since 1999 US Legal Forms has offered the largest and most compliant selection of Vermont legal forms available online.

Our mission is to serve Vermonters by administering our tax laws fairly and efficiently to help taxpayers. Below are forms for prior Tax Years starting with 2020. Every January the Vermont Department of Labor sends 1099-G forms to individuals who received unemployment insurance benefits during the prior calendar year.

Quickly Prepare and File Your 2021 Tax Return. Form IN-114 is a Vermont Individual Income Tax form. For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US.

FEIN Form IN-111 Page 2 of 2 Rev. See better results for vermont tax forms 100 Ad-free and Private. GO TO TAXVERMONTGOV FOR MORE INFORMATION.

Vermont collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Understand and comply with their state tax obligations. The current tax year is 2021 and most states will release updated tax forms between January and April of 2022.

Vermonters who received unemployment benefits in 2021 will need the information on the 1099-G to complete their annual income tax. Download Neeva to see results you can trust for vermont tax forms. Tax Year 2021 Form WH-435 Estimated Income Tax Payments for Nonresident Shareholders Partners or Members.

Details on how to only prepare and print a Vermont 2021 Tax Return. Form Code Form Name. 1020 Social Security Number PERCENTAGE EXCLUSION Use.

Import Your Tax Forms And File For Your Max Refund Today. Most states will release updated tax forms between January and April. TaxFormFinder has an additional 51 Vermont income tax forms that you may need plus all federal income tax forms.

Most Popular Vt Tax Forms. Form IN-111 is the general income tax return for Vermont residents.

Maine Tax Forms And Instructions For 2021 Form 1040me

State W 4 Form Detailed Withholding Forms By State Chart

Printable Vermont Income Tax Forms For Tax Year 2021

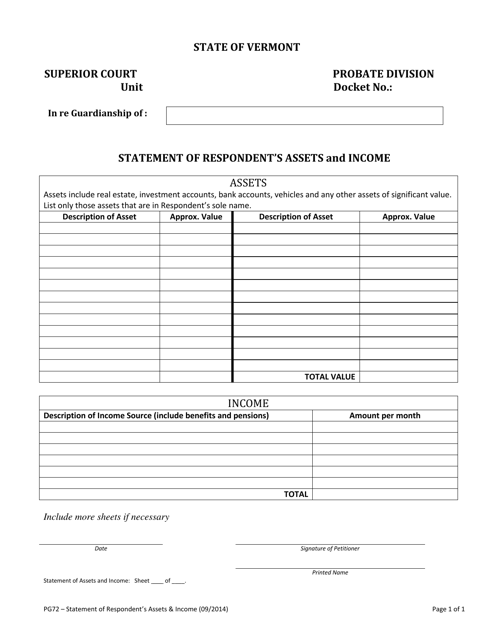

Form Pg72 Download Fillable Pdf Or Fill Online Statement Of Respondent S Assets And Income Vermont Templateroller

What Is A W 9 Tax Form H R Block

Vermont State Tax Information Support

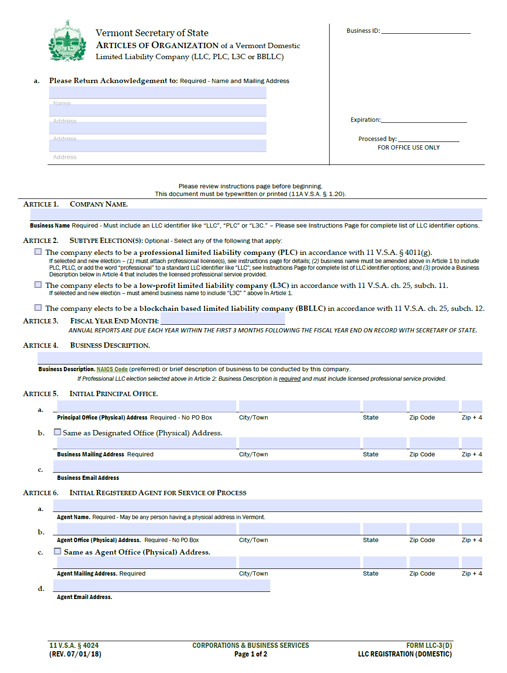

Vermont Llc How To Start An Llc In Vermont Truic

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Tax Year 2021 Personal Income Tax Forms Department Of Taxes

Vermont Tax Form In 111 Fill Online Printable Fillable Blank Pdffiller

Income Tax Form Number 4 Exciting Parts Of Attending Income Tax Form Number Tax Forms Income Tax Income

1098 T Tax Information W 9s Form Bursar S Office Virginia Tech

Strong Personal Income Tax Growth Again Leads Revenue Results For January Vermont Business Magazine